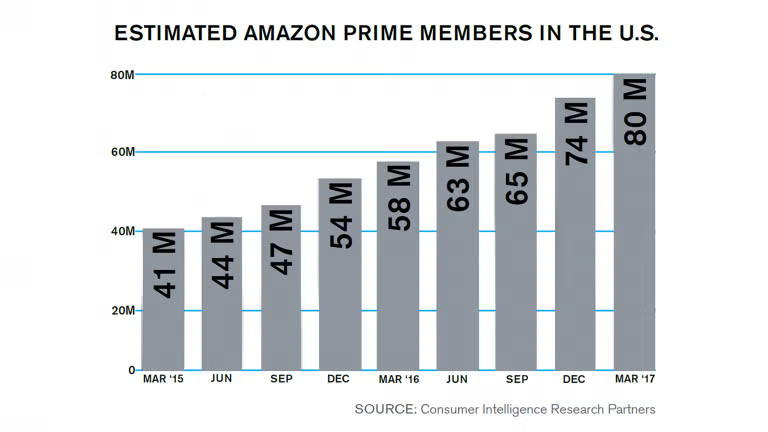

2017 was a pivotal year for retail. For me (and judging by the response from almost everyone else), the biggest industry story of the year was the retail acquisition of Whole Foods by digital giant Amazon. And Amazon continues to build its empire with over 4 million Prime members signing up and/or trialing Prime in one week alone to its already 80 million US members today.

In fact (according to Slice Intelligence), Amazon accounted for 27.2 percent of Black Friday’s online sales, 30.1 percent of Cyber Monday’s and 28.4 percent of all online sales during Cyber Week (November 21st thru 27th). But while Amazon took the majority of online sales, something feels different this year. What? Growth.

While Amazon had the largest share of online sales during Cyber Week, according to Edison Trends, Target saw the largest increase in sales, with online sales increasing by about 4.5x its previous four-week average.

Overall, US holiday retail sales rose 4.9 percent compared to the same period last year (Mastercard Spending Pulse). With growing consumer confidence and signs of increase spending, if the tax cut lives up to its promise, people will start to see more money in their paychecks in early 2018, which should help further drive consumer spending.

So what’s the point? As a brick and mortar retailer, you are probably thinking “my focus is in-store, not on online sales and Amazon.” But many can (and would) argue that Amazon is and has been the #1 retail influencer of the past several years. It’s the new normal; your new normal. What we saw with Amazon’s acquisition of Whole Foods was a pivotal moment in retail and an opportunity to learn from.

Experts are predicting that we will start to see more digital acquisitions of brick and mortar (like Amazon of Whole Foods) and vice-versa. We have seen Albertsons (purchased Plated, the online subscription service) and Walmart (purchased Bonobos, Moosejaw, ModCloth and Shoebuy) begin to follow suit, and this is just the beginning.

In addition to the blending of online and physical, we can expect digital stores to move into the physical space. Leading the way are online retail giants like Rent the Runway, Warby Parker and again, Amazon. What can we learn from this repositioning as we develop our new retail?

- Returns: While retail has become more and more digital, the majority of shopping experiences still take place in store. A key to any online operation is streamlining returns. To do this, brick and mortar has proven the most cost effective. As Amazon continues to expand from online to physical, they have put in place a strategic return partnership with Kohl’s to allow its customers to drop off items they want to return.

- New Store Designs: In November of 2017, Bloomberg announced that Amazon’s cashierless store, Amazon Go, is almost ready for prime time. The Amazon Go team is said to have worked out many of the technical bugs and is starting to hire store-related personnel. Following suite into the “new retail,” retailers are beginning to trial digital concepts of blending online with in-store. As we closed out 2017, retailers were trialing new concept stores that included showroom concepts (order in-store for pick-up or delivery only), stores of the future (with mobility and self-checkout at the forefront) and smaller footprint intentionally designed stores to drive the in-store experience.

- Shipping Strategy: Amazon may not always have the cheapest items or the exact product you want, but what they do well is create a seamless customer experience. Amazon has influenced retailers to advance their own shipping capabilities and with good reason. Consumers expect fast and easy deliveries and buying experiences. Target is among the retailers following suit and at year end, purchased Shipt (a same-day grocery delivery service platform) for $550 million. Their goal through this acquisition is to provide same-day delivery of all major product categories by the end of 2019.

As retailers plan their 2018 and beyond strategies, I expect that they will include features to enable the frictionless experience (think self-checkout and mobility) and a strategy to blend the online and in-store experience to expedite delivery from e-commerce/brick and mortar to consumer (and back again if needed). In closing, it’s a new frontier. It’s not always about what “stuff” you are selling anymore. It’s about the experience. Look at what Airbnb has done. They don’t own any hotels, but they are leveraging data and technology to create a personalized experience that consumers’ desire. Amazon has taught consumers that it’s better to get a seamless buying experience (from your own couch in your pajamas and wait a few days for delivery) than to fight mall traffic and out of stock items for immediate gratification. I for one can’t blame them. So as you build your new retail frontier, how will you forge the new consumer experience? It’s not as far away as you might think.

_white_rgb.png)